OUR SERVICES

Diverse range of fiduciary services for market leading asset managers and top tier transaction advisors.

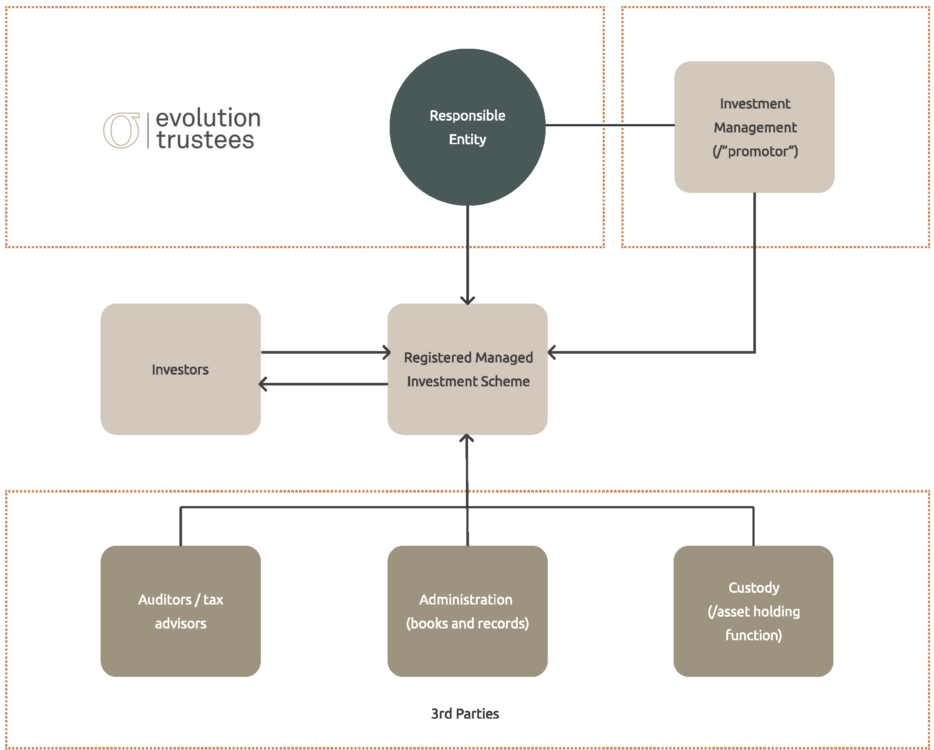

Evolution Trustees works with investment managers intending to raise capital from retail investors by partnering with them to provide strategic advice on fund structures and governance infrastructure. This includes the overarching supervision and collaboration of third party service providers.

Our team has significant experience in dealing with complex transactions and adopts a proactive approach to all matters whether they are simple or complex.

As responsible entity we ensure that each registered scheme is operated in accordance with the Corporations Act, the scheme’s constitution, the scheme’s compliance plan, ASIC policy and other relevant laws and regulations.

We adopt a risk-based approach to operating schemes, and have strong systems and processes to ensure nothing slips through the cracks.

How it works

| Position | Role |

|---|---|

| Responsible entity | Responsible for ensuring the fund and other service providers operates in the best interests of the investors, required to maintain an Australian Financial Services Licence. |

| Investment manager | The ‘face’ of the fund, responsible for promoting the fund and managing investments and providing recommendations/instructions to the Trustee. |

| Custodian | Holds the assets for the fund – A Custodian that meets the requirements of RG133 needs to be appointed. |

| Administrator | Records the transactions of the fund, often also performs investor onboarding and KYC. |

| Auditors / tax advisers | Auditors provide assurance to the unitholders and trustees in respect to the books and records of the fund.

Tax adviser are required to review and calculate fund payments. |

Top-tier custodial services for retail and wholesale funds, offering the highest standard in asset holding in accordance with Australian regulatory requirements. Our in-house built custom technology accelerates service provision while maintaining compliance. Our custodial services are fortified by ASAE 3402 Type 2 (GS007) audits, demonstrating our commitment to internal controls and security.

Our dedicated and highly experienced custodial team is committed to managing your assets with the utmost care and efficiency.

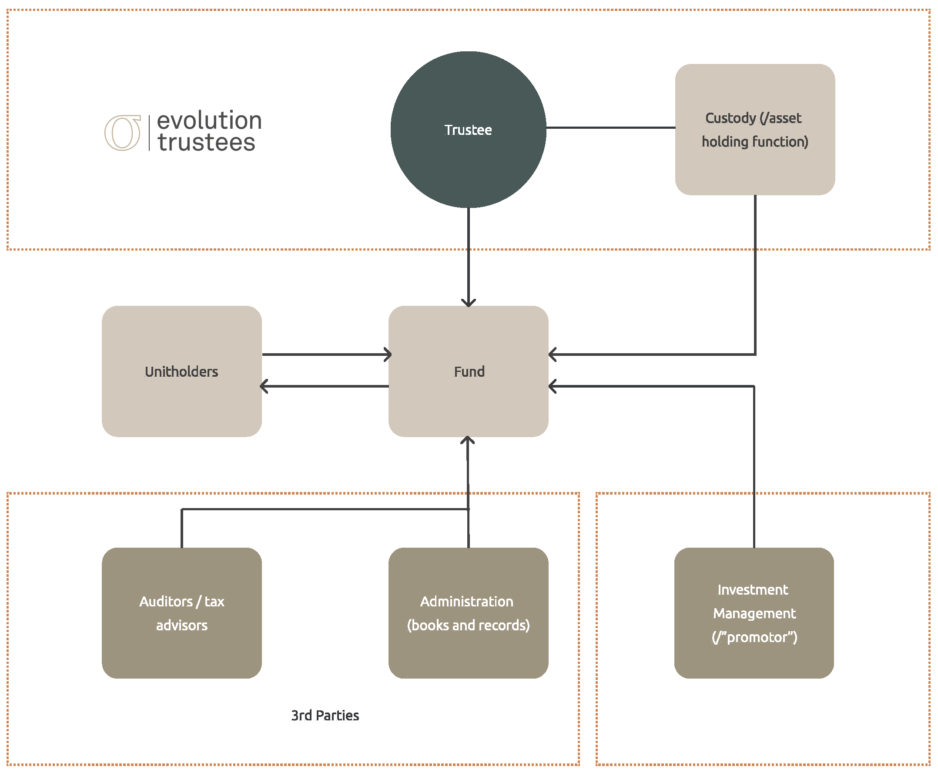

Evolution Trustees is licensed to act as a trustee to wholesale unregistered managed investment schemes.

As a wholesale trustee we work with investment managers and unitholders to ensure that each trust is operated in accordance with each trust’s governing documents (such as trust deeds and information memorandums) and legislation (including trust law and tax requirments) and supervise all 3rd party service providers.

We are able to adapt and tailor our services to your needs including working with a wide variety of fund administrators and unit registrars. As a licensed trustee we will work with you to facilitate the structure you require.

How it works

| Role | Responsibility |

|---|---|

| Trustee | Responsible for ensuring the fund and other service providers operates in the best interests of the investors and required to have an AFSL. |

| Investment manager | The ‘face’ of the fund, responsible for promoting the fund and managing investments and providing recommendations/instructions to the Trustee. |

| Custodian | Holds the assets for the fund – we can be appointed as ‘incidental custodian’ under our AFSL. |

| Administrator | Records the transactions of the fund, often also performs investor onboarding and KYC. |

| Auditors / Tax advisers | Auditors provide assurance to the unitholders and trustee in respect to the books and records of the fund.

Tax adviser are required to review and calculate fund payments and ensure tax returns are consistent with legislative requirements. |

The managed investment trust (MIT) regime supports the competitiveness of Australia as a destination for foreign capital by providing withholding tax benefits to investors from select jurisdictions.

Evolution is a recognised leader in establishing MIT structures. There are specific definitions and complex requirements of MITs which Evolution can assist to analyse, establish and manage.

We act as security trustee for debt structures to independently hold security interests on trust for creditors.

There are multiple benefits of having a security trustee, including:

For debt positions in default, our team has market leading experience in respect to debt restructures and workouts.

Evolution acts as escrow agent for a number of arrangements and transactions. As an independent party, Evolution holds assets on trust to provide transactional certainty for the benefit of all parties in an escrow arrangement.

We work collaboratively with corporates and legal advisers to efficiently establish, secure and release escrow funds providing transaction certainty.

Our debt agency services provides for interest and principal collection and distribution to lenders. We work proactively with borrowers to ensure maintain covenant compliance.

Our team of experts can provide a range of advice associated with the Australian funds management market and relevant licencing requirements and obligations.

These services include the design and implementation of tailored governance, risk and compliance frameworks, operational tools, and other ad hoc services such as Compliance Committee membership.

Through our hands on experience of acting as a fiduciary, and experience deploying best practice compliance management information technology tools, we are able to support our clients build robust compliance functions.

Bespoke services to international and domestic fund managers in respect to maintaining compliance with ASIC requirements for company data maintenance, solvency resolutions and ASIC debt management.

Using industry leading software, we act as ASIC Registered Agents to support you ensure your Australian entities maintain good standing while reducing your compliance burden.