Australian Carbon Credit Units Industry Insights and News – December 24 Quarter

In brief

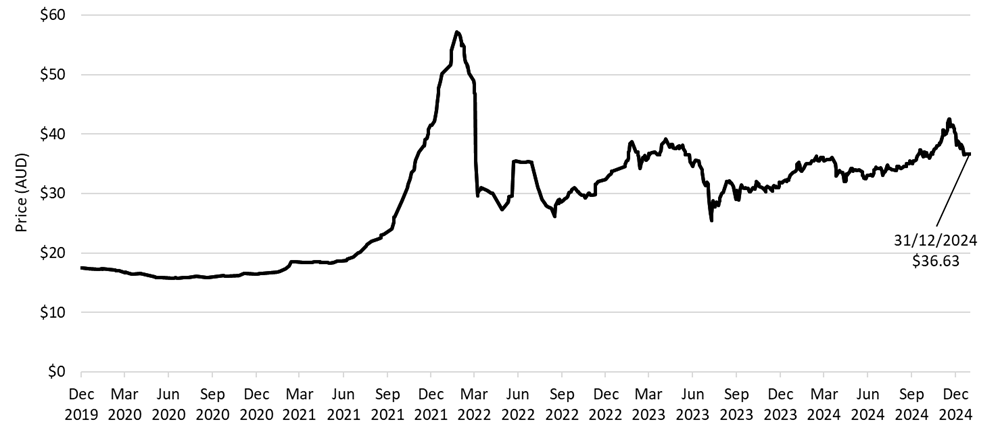

The ACCU market saw a record level of transaction activity in late 2024, driven by compliance demands under the Safeguard Mechanism. Generic Australian Carbon Credit Units (ACCUs) peaked at $42.50 in November 2024 before stabilising around $35-36 in early 2025.

(source: Clean Energy Regulator January 2025)

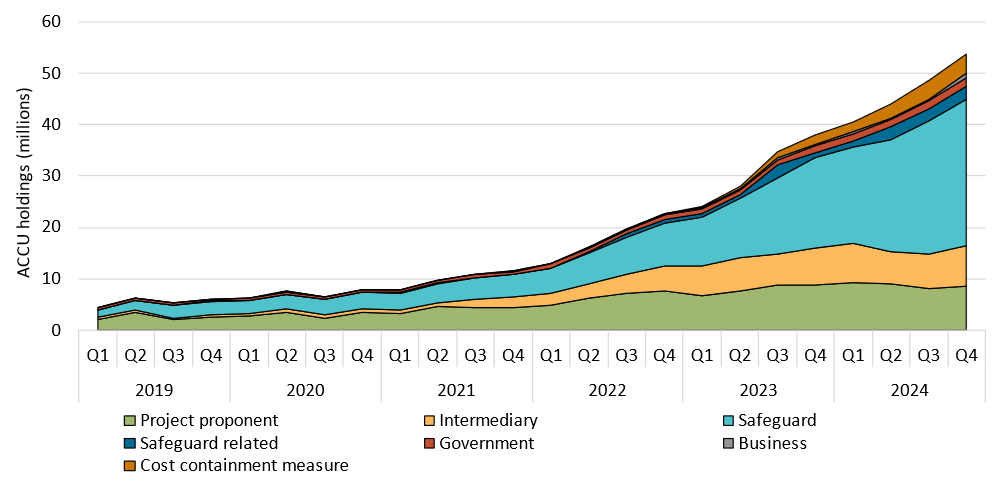

Safeguard entities, preparing for the first compliance period ending March 31, 2025, now hold 62% of the 49.9 million ACCU holdings in the Australian National Registry of Emissions Units (ANREU).

In early 2025, a new carbon unit – Safeguard Mechanism Certificates (SMCs) will be introduced. Safeguard facilities can earn one SMC per tonne of emissions below their baseline. Since ACCUs and SMCs are interchangeable, both can be used to reduce a facility’s net emissions. Safeguard facilities receiving SMCs may trade them internally between facilities owned by a single corporate entity, hold them for future compliance, or sell them to other entities who require them to meet baseline requirements.

Further details

CER Quarterly Carbon Market Report

2024 saw a record 18.8 million ACCUs issued, with 14-15 million likely set aside for future compliance. The Clean Energy Regulator (CER) has also created a 3.6 million ACCU cost containment reserve, capped at $79/tonne, to help limit compliance costs.

Figure 2 below shows ACCU holdings by market participant to the end of Q4 2023. Growth in participation by Safeguard and safeguard-related entities is evident with these entities now comprising around 62% of total ACCUs.

(Source: Clean Energy Regulator January 2025)

Project Registrations and Methods

A record 272 projects were registered under the ACCU scheme in late 2024, dominated by soil carbon, vegetation, and landfill gas projects. However, delays in the Integrated Farm and Land Management method raise concerns about future ACCU supply. Revisions to the Environmental Plantings method aimed at improving accessibility and integrity were made in November.

Australian Carbon Exchange Developments

The CER and the Australian Securities Exchange (ASX) are working together to develop an effective model for a carbon exchange market, initially for Australian carbon credit units (ACCUs). The project aims to increase market transparency and accessibility around the trade of ACCUs.

Transitioning from the existing ANREU to the new Unit and Certificate Register, an integral part of the Exchange, is now underway. In early 2025, account holders should be able to view SMC holdings in the new register, with ACCUs to follow later in the year.

International Carbon Market Mechanisms

At COP29, final rules for Article 6 of the Paris Agreement were established, paving the way for global carbon credit trading. However, full implementation remains uncertain, especially with the U.S. announcing its withdrawal from the agreement.

Outlook

Looking ahead, strong ACCU market activity is expected in 2025, with demand intensifying as the first compliance period ends in March. The impact of SMC issuances on ACCU trading will become clearer post-compliance. Meanwhile, the CER and ASX are developing a new carbon exchange, enhancing market transparency and accessibility.

Disclaimer

This report is for information purposes only and is not intended as an offer or solicitation for wholesale clients as defined in s761G of the Corp[orations Act 2001 (Cth). This report does not take into account the investment objectives, circumstances, financial situation or particular needs of any particular person and does not constitute personal advice. Investors should obtain individual financial advice based on their own particular circumstances before making an investment decision. Evolution Trustees (AFSL 486217) does not guarantee repayment of capital or any particular rate of return. Past performance is no guarantee of future performance. Statements of fact in this report have been obtained from and are based upon sources that Evolution Trustees believes to be reliable, but Evolution Trustees does not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions and estimates included in this report constitute Evolution Trustees judgement as at the date of this communication and are subject to change without notice. This article may contain forward-looking statements regarding our intent, belief, or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. Evolution Trustees does not undertake any obligation to revise any forward-looking statements to reflect events and circumstances after the date of this website.

About Evolution Trustees

Evolution Trustees is a leading independent provider of Australian professional fiduciary services to fund managers, institutional asset investors and debt providers. Established in 2016, Evolution Trustees now has over $A16bn of funds under supervision and provides services to over 160 entities. Evolution holds an AFSL that authorises it to provide general advice and deal in Australian Carbon Credit Units (ACCUs) and eligible international emissions units. Evolution Trustees is a recognised leader in supporting inbound institutional investors establish structures to invest in Australian real estate.

Please refer to our website for more information at www.evolutiontrustees.com.au