Australian Carbon Credit Units Industry Insights and News – September 23 Quarter

In brief

The Clean Energy Regulator (CER) remains on track to deliver around 18 million ACCUs in 2023. Entities operating facilities covered by the new safeguard mechanism (effective Jul23) are continuing to accumulate ACCUs. The CER recently projected demand for ACCUs to increase as facilities determine how they will comply with the new safeguard rules.

ACCU spot prices temporarily fell markedly to a low of $24 early in the new financial year but recovered to around $32 by mid-August and hovered in the $29-$31 range for the balance of the quarter. Analysts suggest the early dip was the result of intermediaries (who facilitate trading between the supply and demand sides of the market) selling down their market positions.

The federal government continues the implementation of various recommendations from the Independent Review of Australian Carbon Credits (‘the Chubb review’).

CER Quarterly Carbon Market Update

The CER noted that ACCU holdings in safeguard mechanism (“SM”) associated accounts (held by entities covered by the safeguard mechanism) had increased through the quarter as expected. The more noticeable trend was for intermediaries to become more actively engaged in the market. By the end of 2Q 2023, Intermediaries had become the largest holders of ACCUs in the Australian National Registry (9.8m). This is around 35% of the total 27.6m ACCUs on the Registry. Project Proponents, in comparison, hold around 9m ACCUs.

SM facilities need to reduce net emissions by more than 200m tonnes by 2030. Entities needing ACCUs to meet reducing baseline obligations can hold ACCUs directly or through third parties and intermediaries. The role of intermediaries is expected to become more prominent as facilities covered by the safeguard mechanism prepare to meet their future obligations.

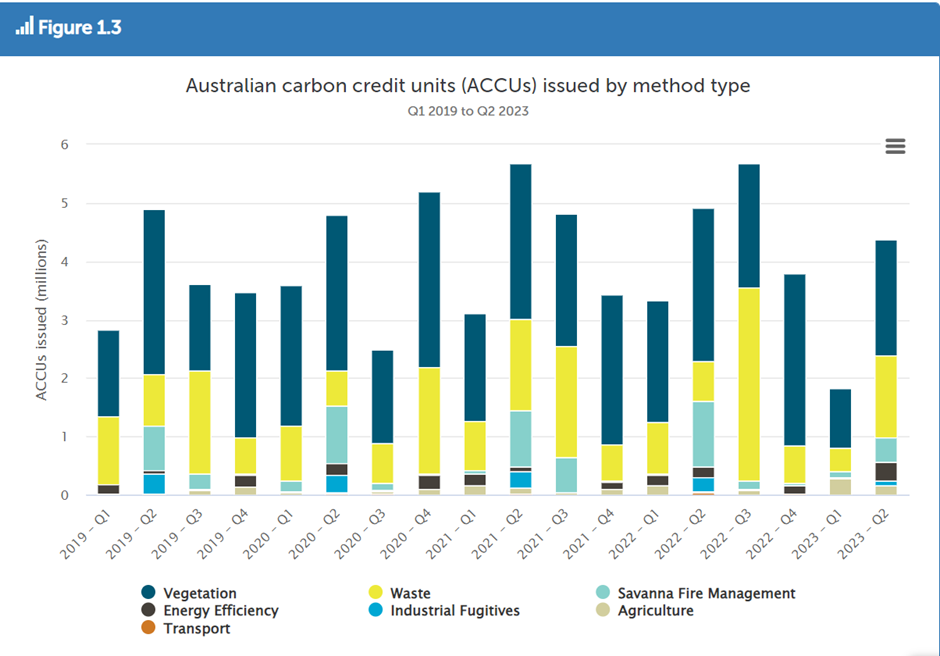

The figure below shows ACCUs issued by method type over time. In 2Q 2023, the first ACCUs under the new 2021 soil carbon method were issued to two Queensland projects. Total ACCUs issued in the first half of 2023 were lower than previous years showing the impacts of the pause in crediting under the Human Induced Regeneration (HIR) Method (included under Vegetation).

Independent Review of Australian Carbon Credits (‘the Chubb review’)

The federal government continued the implementation of recommendations from the Chubb Review. To improve ACCU scheme transparency, the CER has commenced publishing carbon estimation area data for projects on the ACCU scheme project register. The Avoided Deforestation Method has been revoked, preventing registration of new avoided deforestation projects. The next phase will include defining the ongoing role of the Commonwealth Government as a purchaser of ACCUs and delivering a new (proponent-led) process for new method development.

The Climate Change Authority (“CCA”), an Australian Government statutory agency that provides advice to government on climate change policy, has commenced a review of the legislation underpinning the ACCU Scheme focussing on:

- Securing integrity – focusing on additionality, permanence, and leakage.

- Managing supply and demand – including land use competition and supporting participation.

- Scaling emissions removals – including how the scheme can support engineered removals.

- Alignment with the Paris Agreement – including international trade considerations.

Outlook

The early signs of the impact of the Safeguard Mechanism can be expected to intensify as demand for ACCUs increases and facilities determine how they will comply with the safeguard rules. The more active engagement of intermediaries in the Australian carbon trading market can only be expected to grow as overall demand for ACCUs rises.

Disclaimer

This report is for information purposes only and is not intended as an offer or solicitation for wholesale clients as defined in s761G of the Corp[orations Act 2001 (Cth). This report does not take into account the investment objectives, circumstances, financial situation or particular needs of any particular person and does not constitute personal advice. Investors should obtain individual financial advice based on their own particular circumstances before making an investment decision. Evolution Trustees (AFSL 486217) does not guarantee repayment of capital or any particular rate of return. Past performance is no guarantee of future performance. Statements of fact in this report have been obtained from and are based upon sources that Evolution Trustees believes to be reliable, but Evolution Trustees does not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions and estimates included in this report constitute Evolution Trustees judgement as at the date of this communication and are subject to change without notice. This article may contain forward-looking statements regarding our intent, belief, or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. Evolution Trustees does not undertake any obligation to revise any forward-looking statements to reflect events and circumstances after the date of this website.

About Evolution Trustees

Evolution Trustees is a leading independent provider of Australian professional fiduciary services to fund managers, institutional asset investors and debt providers. Established in 2016, Evolution Trustees now has over $A10bn of funds under supervision and provides services to over 160 entities. Evolution holds an AFSL that authorises it to provide general advice and deal in Australian Carbon Credit Units (ACCUs) and eligible international emissions units. Evolution Trustees is a recognised leader in supporting inbound institutional investors establish structures to invest in Australian real estate.

Please refer to our website for more information at www.evolutiontrustees.com.au